These South African jobs will disappear as technology takes over

The National Economic Development and Labour Council (Nedlac) has released a new report looking at how the fourth industrial revolution is set to hit jobs in the country.

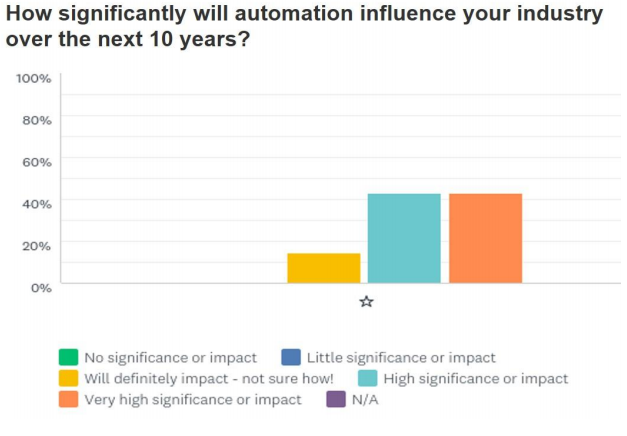

Overall, respondents were of the opinion that automation, globalisation and demographic change could have a significant impact on their industries, causing some jobs and activities to disappear, while creating opportunities for new jobs and activities to emerge.

“The speed and depth of technology adoption drives business growth, new job creation and the need for augmentation of existing jobs, provided it can fully leverage the talents of a motivated and agile workforce that is equipped with skills to take advantage of new opportunities,” the researchers said.

“This can only be achieved through proactive retraining and upskilling. Conversely, skills gaps – both among workers and among an organisation’s senior leadership—may significantly hamper new technology adoption and therefore business growth.”

As part of the report, the Institute for Futures Research (IFR) at Stellenbosch University highlighted emerging trends in 12 industries including healthcare, the informal sector, energy, transport, the public sector, services, education, agri-processing, financial services, mining, manufacturing and agriculture.

This was based on insights gained from desktop research, a workshop with the IFR research colloquium and the interviews conducted as part of this project. The overviews capture trends of a generic and international nature applied to South African industries.

Below is an outline of the new jobs which are likely to be created in South Africa due to the adoption of new technology – and the jobs which are likely to be phased out according to this data.

Healthcare

Ageing populations, the rise of non-communicable diseases and the emergence of intelligent, connected ‘wearables’ are driving an industry shift away from curing disease in the short term toward preventing / managing disease and promoting overall well-being (wellness) in the long term, the researchers said.

Life expectancy is also projected to increase from 73.5 years in 2018 to 74.4 in 2022 – bringing the number of people aged over 65 globally to more than 668 million, or 11.6% of the total global population.

Energy sector

The macro trends driving change in the oil and coal industry do not occur in isolation from one another, the researchers said.

Whilst technological change is a primary driver, pressure to control climate change by limiting CO2 emissions will push us toward reducing single-car use, and business model, demographic and values changes could be the major driver of changes in mobility usage.

“Urbanisation, as well as an increased consumer focus on environmentally friendly and healthy lifestyles, could encourage cycling, walking and car sharing as alternative forms of mobility.”

Transport

Key trends shaping the future of the global and local transport industry include technology, environmental factors and social aspects.

Social trends, in particular, can play a significant role. These include changes in human behaviour, rising cost of living, ageing population, sharing economy and no-ownership mentality, travel patterns and urbanisation.

Technologies like hyperloop, drones, UAVs and autonomous vehicles are said to be the biggest potential disruptors for the future of the transport industry.

Public sector

In most countries across the globe, the public sector is transforming, downsizing, revamping, and being overhauled.

The pace and dimensions of this change are unprecedented – driven by budgetary constraints and new approaches to public service delivery.

Public Sector refers to all levels of government – defence, education, federal government, health & human services, justice & security, local government, revenue, regulatory & central agencies, state and territory government, transport and infrastructure.

Services

The service industry is generally believed to require person-to-person contact in the delivery of mostly intangible products.

Service industries include everything from business consulting to health care to education. Market trends in the service industry are being influenced primarily by the use of technology to streamline operations, provide resources to staff, and, in some cases, to replace the need for staff.

Education

In an increasingly globalised and connected world, education is the heart of economic and social prosperity – enhancing competitiveness and improving the lives of every single person.

Agri-processing

Urbanisation demands a different organisation of the food system in which the preservation of foodstuffs becomes strategic.

This is accompanied, in middle-income developing countries, by a dietary transition stimulating new food categories, and by the demand for convenience and ready-to-eat foods.

Financial sector

In South Africa, our financial services sector is made up of specialist firms, insurers, personal finance providers as well as retail banks.

A number of driving forces are shaping this industry, including:

- Rapid digital adoption;

- Software platforms, digitisation and the development of applications;

- Better connectivity;

- Customer preferences and expectations;

- Alternative models of lending and capital raising;

- Technologies like big data analytics and AI;

- Non-traditional players.

Mining

In South Africa, mining had a significant influence on how our economy and, in many places our societies, developed. At the moment, the sector is under pressure.

Falling commodity prices and the depletion of easier-to-reach ore bodies put pressure on the profitability of mining operations. Mining in South Africa is mostly deep and therefore risky and expensive.

A number of technologies are showing interesting promise – drone applications, proximity sensors and improved communication systems are changing underground mining, while software applications are creating efficiencies across the whole operation.

Automotive

The trends driving change in the manufacturing sector, will also be applicable to the automotive industry.

In South Africa, the automotive industry is a significant player in terms of manufacturing value added in the manufacturing sector.

The trends driving change in the transport industry will similarly influence the automotive sector.

[“source=businesstech”]